Planned Giving

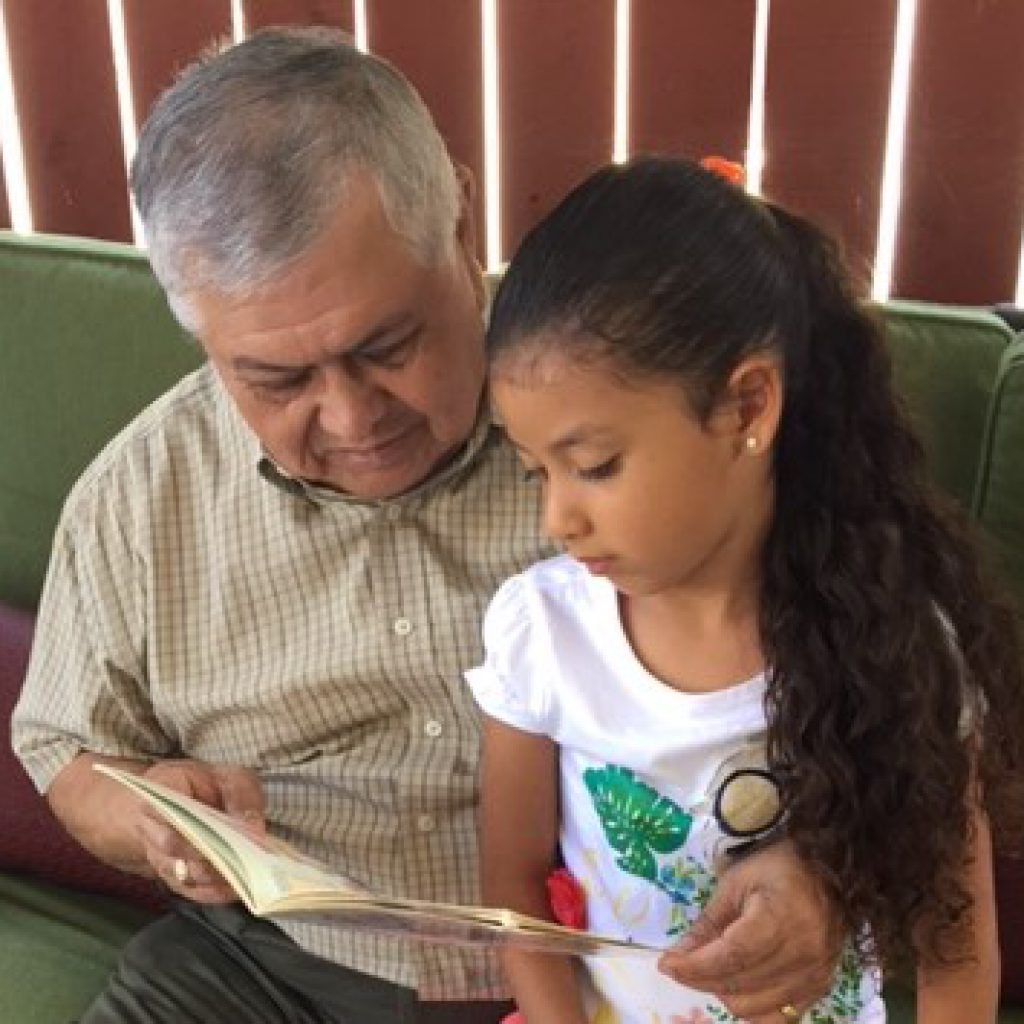

Create a lasting legacy and provide for the future of American Indian families.

There are various ways that Walking Shield benefits from your support:

Designating Walking Shield as the beneficiary of your retirement plan, life insurance policy, commercial annuity through a Beneficiary Designation is a way to support our mission and make a lasting statement about what matters most to you.

A Bequest, a gift though your will or trust, is the easiest way to support our mission.

Charitable Remainder Trusts that form part of your estate planning supports our mission while setting up annuities or variable payments to you from setting u p this estate planning option.

Charitable Lead Trust is a gift from that makes payments to Walking Shield for a specified period of time. At the end of the period, it distributes the trust property to a specific beneficiary. They payment can be either a fixed annuity amount or an available unitrust amount.

Charitable Gift Annuities is a gift that gives you the opportunity to support Walking Shield’s work. This gift not only provides you with regular payments as you support our work; you will also receive a variety of tax benefits, including a federal income tax charitable deduction.

Current Outright Gifts include stock, real estate and personal property. These gifts can be sold by Walking Shield and transferred to a monetary value.